-

1200MT Crane

Handled complex lifts effortlessly.

-

150MT

Max. Weight handled in single lift.

-

1275Peak Manpower

Successfully handled at a single site.

-

7.2Million+ Safe man hours

With a Zero LTI record.

Our Clients

Our Valued Clients

From India to Europe, Middle East, Africa, and beyond, we have partnered with some of the most respected names in the industrial world, delivering projects with consistency and excellence.

-

Industry

Expertise70+ years of proven experience across Pulp & Paper, Power, Mining & Mineral, Oil & Gas.

-

Health

& SafetyZero-compromise with safety. We follow global HSE practices and continuous workforce training.

-

Quality with

CommitmentPrecision-driven projects backed by strict QA/QC and international standards.

-

Planning &

Timely ExecutionDisciplined project planning and resource management ensure on-time delivery.

-

Project

ManagementSeamless coordination, transparent reporting, and efficient execution from start to finish.

News & Updates

Latest achievements and industry insights from SFE.

-

Andritz 100 TPD tissue machine installation work started at TNPL unit II Manaparai, TN.

-

Valmet 100 TPD tissue machine installation work started for Andhra Pradesh Paper Mills, Rajahmundari, AP.

-

JKPM’s BCTMP plant erection work on full swing.

-

Installation work started for Crown Paper Mill’s 200 TPD Valmet Tissue Machine TM4 in Dammam, KSA.

-

Epsilon

-

Installation completed for Tissue Machine for Metsa at Mariastad, Sweden. Machine Commissioned successfully in sept 2025.

-

We are proud to announce the acquisition of a new 180 MT mobile crane from XCMG, China.

-

SFE has been awarded the piping & equipment erection work at the Epsilon Carbon – Ashoka Project, Jharsuguda. The work is currently in progress.

Our Solutions

Constructing Industries

Success Stories

Every Success Has a Story

-

Pulp & Paper Industry – Juthor Paper Manufacturing Company (KSA)

Pulp & Paper Industry – Juthor Paper Manufacturing Company (KSA)Delivering a 200 TPD Tissue Machine with Precision

SFE executed the supply, fabrication, installation, testing, and commissioning of a Toscotec 200 TPD Tissue Machine at Rabigh, KSA. The project was completed within the scheduled timeframe while ensuring strict safety and quality compliance.

View all projects -

Mining & Resources – Prony Resources (New Caledonia)

Mining & Resources – Prony Resources (New Caledonia)Integrated Industrial Construction & Installation

SFE successfully executed steel structure, mechanical, and piping installation along with electrical & instrumentation commissioning works for Prony Resources in New Caledonia. The project showcased our ability to deliver complex multi-disciplinary solutions with precision and safety.

View all projects -

Oil & Gas – Collombey Refinery (Switzerland)

Oil & Gas – Collombey Refinery (Switzerland)Safe & Efficient Refinery Dismantling

SFE carried out the dismantling of the Collombey petroleum refinery in Switzerland, ensuring strict compliance with international safety and environmental standards throughout the process.

View all projects

Client Testimonials

Voices of Our

Valued Partners

Contact us

Your Trusted Partner for

Comprehensive

Industrial Solutions

Worldwide

Poised to respond to your questions, we offer expert guidance in selecting the most effective approach for your next erection and installation project.

Contact us

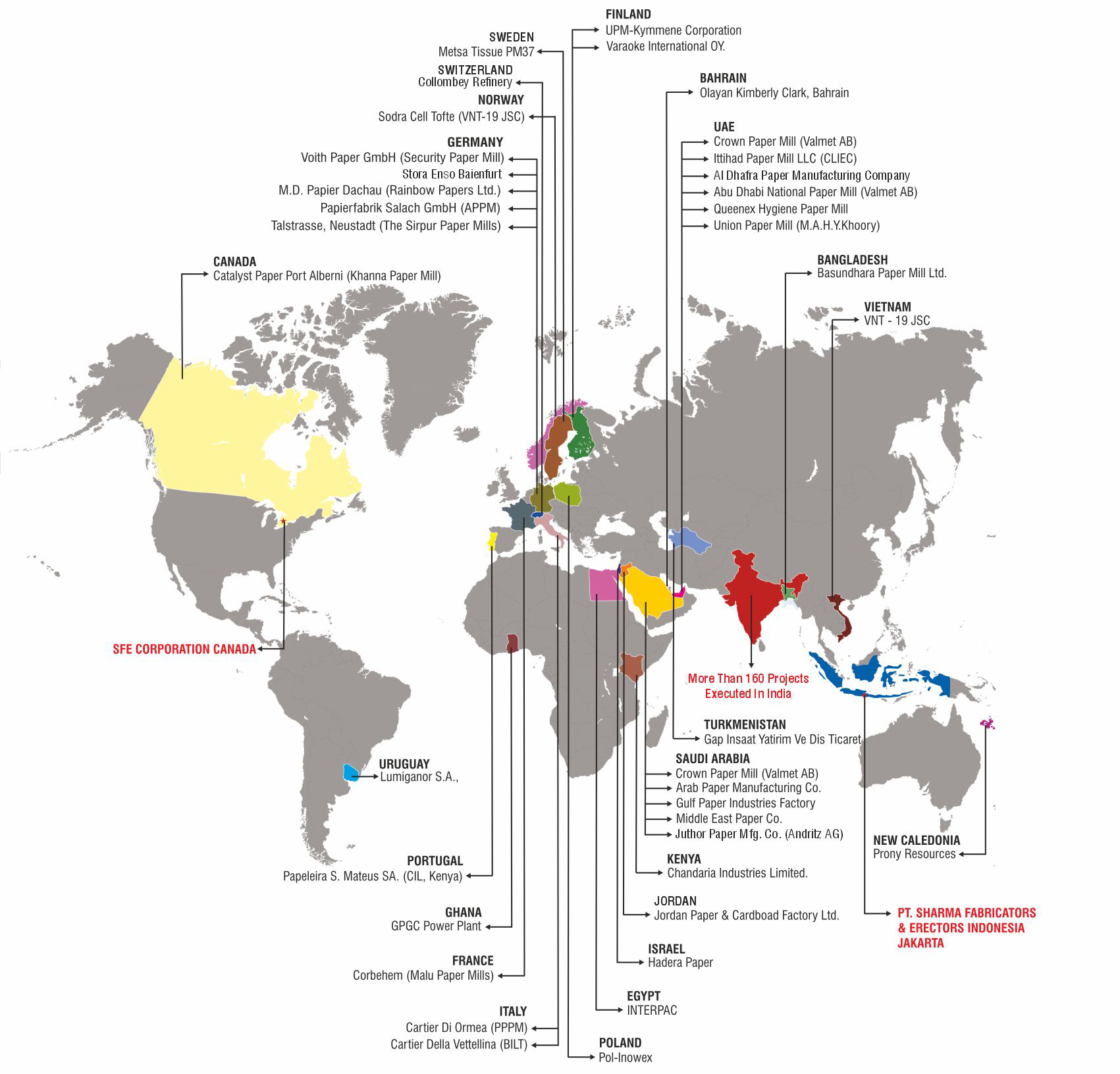

Our Presence

Strong Global Presence

Backed by Proven Experience.

- Bangladesh

- Germany

- Jordan

- Saudi Arabia

- Bahrian

- Ghana

- Kenya

- Turkmenistan

- Canada

- Italy

- Norway

- UAE

- Egypt

- India

- New Caledonia

- Uruguay

- Finland

- Indonesia

- Poland

- Vietnam

- France

- Israel

- Portugal

- Sweden

- Switzerland

-Ltd..jpg)